Corporate

Accounts

Discover the ISX dedicated corporate accounts, tailored for the modern financial landscape and execute payments or transfer funds across the world, all through ISXMoney®, a fully regulated and secure platform.

Borderless Corporate Accounts

ISX's EU and UK corporate eMoney accounts offer a seamless gateway to international business finance, empowering businesses and financial institutions to grow and expand across borders with ease.

IBAN issued in your business' name

EU banking regulations compliant

SEPA access to the EU market

Sort Code issued in your business' name

Regulated by the FCA

Access to Pay.UK clearing house

Manage 23 currency accounts

Seamless money movement worldwide

Easily exchange currencies

An EU IBAN business eMoney account issued in your business's name enables seamless financial management and provides full access to the EU SEPA network for efficient international payments.

Successfully navigate and thrive in the UK business landscape with a dedicated SORT code and account number registered in your business's name. Gain direct access to the UK market through Pay.UK payment systems.

Enjoy the advantages of robust security, fraud protection, and real-time financial insights with our ISXMoney® money portal.

Multi-Currency Accounts

Embrace global growth by managing 23 currencies within a single platform, avoiding hidden fees & complexities.

Benefit from rapid cross-border transactions, real-time expense management, and advanced security that gives you peace of mind. Available worldwide, these accounts offer numerous benefits for individuals and businesses:

23 Currencies including: EUR, GBP, USD, YEN, CAD, AUD and more.

Send funds through SWIFT, BACS FPS, SEPA, SEPA Instant and more.

Hold and store funds in any major currency directly within your account.

Access additional services like card acquiring, SEPA Direct Debit (SDD) and a proprietary open banking platform.

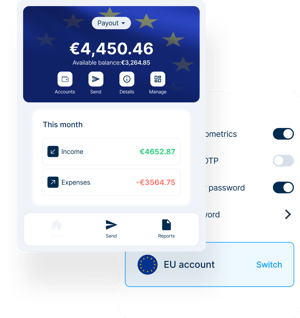

Online Banking Platform

Experience seamless funds management and multi-currency payments through ISXMoney®, an intuitive online banking platform, designed to simplify your corporate account operations.

Manage Finances

Simplify the cross-border transactions by eliminating manual currency conversions. Expand into new markets worldwide using our secure and compliant platform tailored for smaller businesses, financial institutions and larger enterprises.

How it works:

-

Monitor your finances online with real-time insights.

-

Execute all payments and transfers through a single platform.

-

Simplify your global payroll and day-to-day financial operations.

Achieve Your Financial Goals

Our streamlined onboarding process ensures a seamless integration.

Prompt assistance from experienced account managers whenever challenges arise.

Partner with experts who understand your business requirements.

Advanced Features

Issuance and Redemption of Electronic Money, backed by 100% audited deposits at reputable, globally known institutions.

Issuance of Business Debit Cards (Diners®) with global Pulse® ATM access, incorporating fraud detection via strong customer authentication and identity verification.

On & Off Ramp fiat services for appropriately licensed digital asset, crypto, and virtial assets providers

ISX Foreign Currency Services in multiple currencies across our platform.

Regulated & Secure

ISX Financial EU Plc is a EEA authorised and regulated EMI in the EU by the Central Bank of Cyprus and its subsidiary ISX Financial UK is authorised and regulated in the UK by the Financial Conduct Authority (FCA). To safeguard customer funds, all short term liquidity pools are stored directly with Central Banks & long term held funds are safeguarded with leading credit institutions.

ISX Financial UK Ltd is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011, Firm Reference 901034, for the issuing of electronic money. All client funds are safeguarded with leading credit institutions.

As an EEA-authorised EMI, we ensure secure and compliant electronic money services across the European Economic Area.

Further Features

Integration with Paydentity™ to mitigate fraud via robust identity verification processes.

Advanced monitoring and secure handling of personal information to mitigate fraud and ensure privacy compliance.

Automated payment of bills and accounts via account direct debit or cards.

Services subject to customer due diligence, identity verification and background checks.

.png?width=1681&name=Interim-Report-Cover-Megamenu%20(1).png)