Global Card

Acquiring

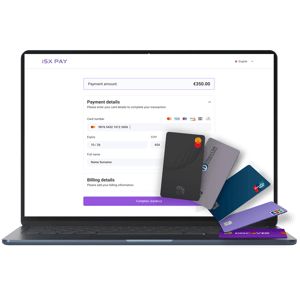

Accept card payments securely and globally through ISXPay®'s card acquiring services. With one integration, your business can process credit and debit card payments in over 100 currencies.

ISX Pay - Simplify Credit and Debit Card Payments

ISX Pay® simplifies the complexities of card acquiring

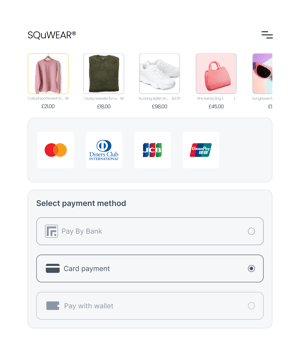

By combining acquirer, processor and fraud protection services into one robust payment gateway, ISXPay® simplifies the complexities of online card transactions. The platform supports multi-currency transactions and accepts major card networks such as Mastercard, UnionPay, and Discover®.

Payment choice

Reach international markets with cross-border acquiring, backed by security that includes 3D Secure, PCI DSS and PSD2 compliance and real-time fraud detection. The streamlined onboarding process supports KYC/KYB requirements across business types and provides hands-on assistance throughout integration.

Business Growth & Revenue Optimisation

Maximise your earning potential with intelligent tools and strategies that boost transaction approval rates and reduce chargebacks.

Save money on processing fees with our competitive rates and transparent pricing structure.

Accept a wide variety of payment methods, and benefit from customisable solutions that align with your business objectives.

Expand your customer base to global markets and streamline cross-border transactions with our comprehensive payment solutions.

Leverage detailed transaction data to make informed business decisions and optimise performance.

Safeguard sensitive customer information with robust security measures and compliance standards firmly in place.

Advanced Features

Issuance and Redemption of Electronic Money, backed by 100% audited deposits at reputable, globally known institutions.

Issuance of Business Debit Cards (Diners®) with global Pulse® ATM access, incorporating fraud detection via strong customer authentication and identity verification.

On & Off Ramp fiat services for appropriately licensed digital asset, crypto, and virtial assets providers

ISX Foreign Currency Services in multiple currencies across our platform.

Safe Online Transactions

Added Protection for Every Online Transaction

3D Secure (3DS) adds an extra layer of authentication to card payments made online, protecting both the merchant and the business. The name refers to the three domains involved: the card issuer, the merchant, and the secure 3DS infrastructure that facilitates authentication.

When a transaction is flagged as high risk, 3DS prompts the cardholder to verify their identity — typically via a password, PIN, or biometric — ensuring the payment is authorised by the rightful owner.

Further Features

Integration with Paydentity® to mitigate fraud via robust indentity verification processes.

Advanced monitoring and secure handling of personal information to mitigate fraud and ensure privacy compliance.

Automated payment of bills and accounts via account direct debit or cards.

Services subject to customer due diligence, identity verification and background checks.

Your Data Is Our Priority

Detect and prevent fraudulent transactions, and fight against chargebacks, all in real-time.

Ensuring PSD2 compliance by providing a simple, yet patented solution to SCA by implementing a 2FA process upon card verification.

Our multifaceted payment gateway can route and process your customers' transactions and find the fastest payment channel automatically, offering you various options, including cross-border.

Get access to a wealth of data for transaction monitoring, risk management and optimisation through our intuitive user dashboard.

.png?width=1681&name=Interim-Report-Cover-Megamenu%20(1).png)