Verification of Payee (VoP): Strengthening Trust Across Europe

In an increasing digital financial landscape, the need for secure and accurate payments has never been greater. Fraud prevention and transaction accuracy are not just operational requirements, they are the foundation of trust between businesses, merchants and their customers.

To address these challenges, the European Payment Council under the EU Instant Payments Regulation (IPR) - 2024/886, introduced the Verification of Payee (VoP) Scheme, a regulatory requirement designed to enhance payment security across the Single Euro Payments Area (SEPA).

What Is Verification of Payee (VoP)?

Verification of Payee is a regulatory requirement that ISX® must offer the payor as a means to verify that the payee’s details match the details provided before any payment is executed. The Payor may opt to continue the payment even if there is no name match, noting however, that there is a risk of the payment being misdirected if they do so.

Corporate payors utilising our bulk MassPay service may opt out of the service entirely.

What happens in the background?

When the payor initiates a SEPA Instant Credit Transfer (SCT Inst) or a SEPA Direct Transfer (SCT), the payor’s Payment Service Provider (PSP) sends a VoP request to the payee’s PSP. This request includes the payee’s International Bank Account Number (IBAN) and either its name or an identifier such as a VAT number or Legal Entity Identifier (LEI).

The payee’s PSP checks the provided information against its records and responds with whether the payee details entered when initiating a payment corresponds with the account holder details associated with the IBAN. This reduces the risk of fraud, misdirected payments, and strengthens confidence in every transaction.

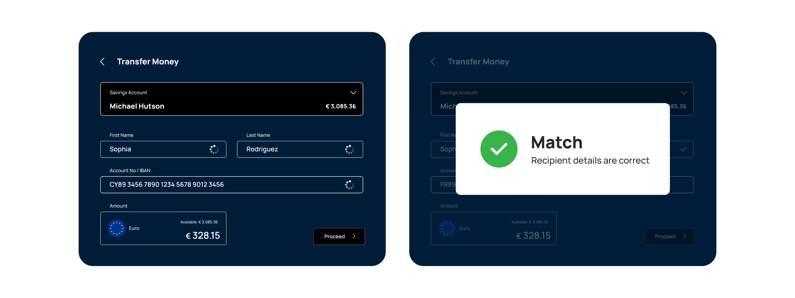

How it works:

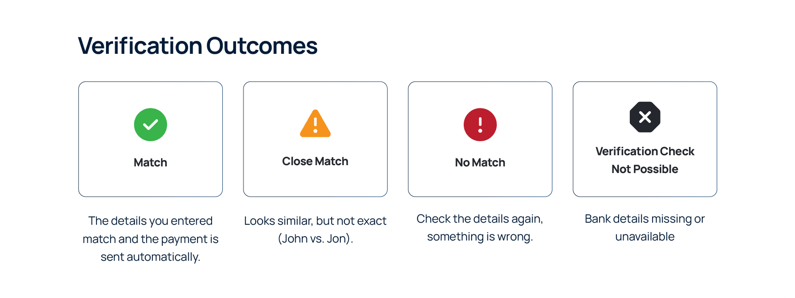

When initiating a payment within the SEPA Network, our system will verify the entered details with the beneficiary’s bank and return one of the following outcomes before payment execution:

- Match - the details entered match and the payment is sent automatically.

- Close match - the details entered are similar to the payee account, but are not an exact match.

- No match - the details entered do not match the payee account. Check the details again before proceeding.

- Verification check not possible - this may happen if the details entered are missing, or unavailable at the recipient bank.

Name checks happen automatically prior to sending funds to a EUR IBAN recipient that’s in the SEPA zone. You can still send out money regardless of the match result, however, this is at the payors discretion and responsibility.

Why this matters

- Better security: Payments undergo verification before being processed, reducing fraud and misdirected payments.

- Regulatory compliance: PSPs now have to follow the evolving European regulations.

- Customer confidence: End users are empowered with greater transparency and control, deciding whether or not to proceed with a payment if mismatches occur.

For businesses and merchants, this means better operations and stronger customer trust.

ISX’s products that will feature VoP: Effective October 9th, 2025

Effective 9 October 2025, products within the ISX ecosystem such as ISX Money® and flykk®, will support the Verification of Payee feature.

This rollout underscores the company’s commitment to embedding security, compliance and customer trust into every transaction. By integrating VoP, ISXMoney® and flykk® products will empower businesses, and end users alike, to operate confidently within the SEPA framework.

What’s next

The European Payments Council’s Verification of Payee Scheme represents a major step forward for EU payments. By ensuring accuracy at the point of transaction, it delivers stronger safeguards for businesses, merchants, PSPs, and consumers.

Need help?

For any clarifications reach out to your dedicated Relationship Manager or contact us at emoney@isxfinancial.com